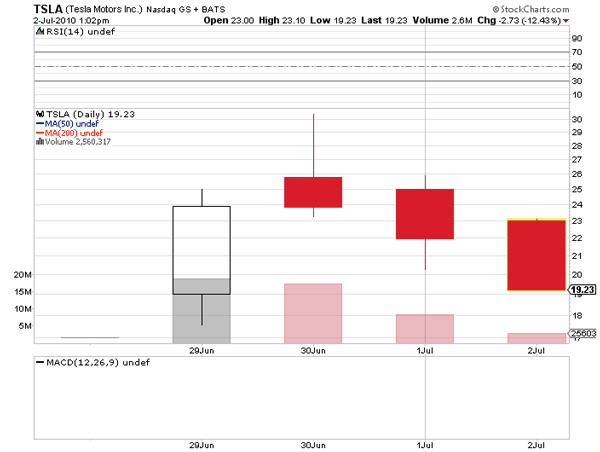

CBOE Holdings and Tesla Motors Fall

Most investors agree that making a decision on when to sell is much more difficult than deciding when to buy. Recently Tesla (NASDAQ: TSLA) and CBOE Holdings (NASDAQ: CBOE) have fallen from higher levels and have even broken their IPO issue prices. In uncertain markets like the one we are currently in, you have to think more like a trader than an investor. That means taking a 5 or 10% gain instead of holding and waiting for a home run. You can always re-enter the position at higher levels if you choose.

Most investors agree that making a decision on when to sell is much more difficult than deciding when to buy. Recently Tesla (NASDAQ: TSLA) and CBOE Holdings (NASDAQ: CBOE) have fallen from higher levels and have even broken their IPO issue prices. In uncertain markets like the one we are currently in, you have to think more like a trader than an investor. That means taking a 5 or 10% gain instead of holding and waiting for a home run. You can always re-enter the position at higher levels if you choose.

With penny stocks this proves to be even more difficult due to increased volatility and lower liquidity. Many traders take profits by selling one-quarter of their position at a time as the stock moves higher. Moving stops up as they take profits and usually leaving the last quarter of the profitable position on the board to look for a massive gain and generally using a stop at the entry price to protect the last piece. Others use the same strategy, but choose to liquidate positions in thirds. The latter strategy saves a little on commissions but increases risk.

Another strategy that is simple but a little more risky, is always selling half the position on a double in the stock. However, huge gains like these this happens less frequently. Although sometimes hot penny stocks take off so quickly we don’t have time to get out. They often fall faster than they spike. This is why we preach being prepared. Set a limit order in advance if you don’t have time to look at a screen. Keep in mind that these profits add up and will allow you to take more risk on the remainder of the position. This strategy doesn’t just apply to NYSE issues. It applies to penny stocks on the OTCBB and pink sheets too. Just make a plan on how to exit and don’t be too greedy. There are tens of thousands of penny stocks to trade and many of them are showing huge gains daily. Finding the right one at the right time is the tricky part.

Tesla IPO and Its Wild Ride

Tesla IPO and Its Wild Ride