Tesla IPO and Its Wild Ride

Tesla IPO and Its Wild Ride

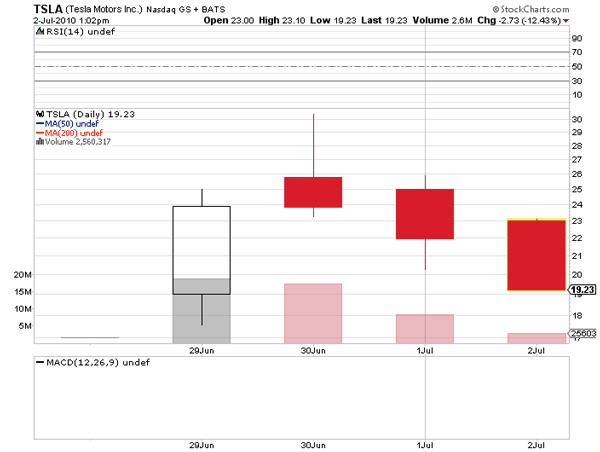

Going into the long weekend, it seems that shares of Tesla (NASDAQ:TSLA) have come back to earth. IPO shares of TSLA were priced at $17 and surged to 30.42 on it’s second day of trading. A massive gain considering that traders had time to buy aftermarket shares under $18. Was a lesson learned here for investors who paid more than $25 ? Yes, I think so.

TSLA is a company that has a great CEO, a cutting edge product and has never had problems raising money despite being unprofitable. However, the saying “What goes up must come down” came into play on TSLA. It’s probably safe to say that some of the aftermarket buying came from buyers who have a legitimate long term perspective. These are investors who are investing with a horizon so long that makes paying a point or two higher almost irrelevant. But what was the short term trader thinking at $30 a share ? Buying TLSA for a short term after it’s huge run is a classic example of why it’s sometimes better to sit on your hands. While the company has tremendous potential, the market mechanics remain the same.

It doesn’t matter if it’s a blue chip on the NYSE, a mid-cap or an OTCBB issue. Smart traders will always take profits. The lesson learned here is not to chase stocks that have made huge moves in short time frames. Looking at charts and decreasing volume at the highs is key. This applies not only to TSLA, but to hot penny stocks too that are on the move.

Related posts:

- Tesla IPO and OTC:ELCR The much anticipated Tesla Motors IPO will begin trading on...

Related posts brought to you by Yet Another Related Posts Plugin.