STOCKS vs. BONDS Debate Heats Up

Stocks vs. bonds has been a debate for the ages. Mainly because risk averse investors generally look for stability and yield and more speculative investors trend towards stocks and their potentially dynamic returns.

Stocks vs. bonds has been a debate for the ages. Mainly because risk averse investors generally look for stability and yield and more speculative investors trend towards stocks and their potentially dynamic returns.

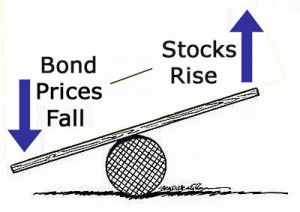

Well which asset class is better ? That depends on market conditions. Recently for instance, some retail investors and institutions have moved towards safety as the stock market imploded. Consequently, bond prices have been driven up and yields have gone lower.

At this point it remains extremely difficult for anyone who is seeking a reasonable dividend stream to obtain it unless they purchase fixed income products that are either very risky or have ridiculously long maturities.

Does this recent trend signal stock market capitulation ? Maybe not, but we might be close. Because of the reduced rates, income oriented buyers are being forced to look at investments on the equity side that they normally would stay away from. Utility stocks and proven Dow names with reliable dividends seem to be fashionable currently for these super conservative buyers.

Now there is an old market saying that states that selling begets selling. Common sense tells me that the inverse is true as well. If the stocks vs. bonds ratio is out of the norm for income investors, then bond buyers might have to bite the bullet and turn to income stocks. The money market rates have simply left them no other alternative.

STOCKS vs. BONDS Argument Continues

In times like these you have to ask yourself one question. Is it worth going out 25 or 30 years on a maturity basis to capture the returns you are used to in a corporate bond that is marginally investment grade ?

Well that is the decision that many are faced with, so don’t be surprised if you start to see Wall St. flood the market with new hybrid products that resemble balanced funds and are mixed with low yielding bonds and high paying dividend stocks. Believe me when I tell you, somebody as I speak, is figuring some marketing plan to take advantage of the current stocks vs. bonds debate.

If you are an income investor, better judgment is probably telling you not to rush funds heavily into either side of this argument. However, you probably have heard or read that the U.S. has been turning into Japan for the last 15 years as well. So it’s basically a tough decision right now. The best way to play this on an income orientated basis might be simply by watching Europe. I know I am stating the obvious, but panicking into a longer term bond, just because of uncertainty and lust for yield can cost you in the long run.

Owning a 30 year piece of paper in a rising interest rate environment isn’t pleasant. Even if takes 5 years to actually happen. So check back for more color on this situation, and monitor some different income bearing equities. The outcome is this stocks vs. bonds discussion is iffy, but I can guarantee you one thing, this debate will go on forever.

More Penny Stock News, IPO Updates and Stock Market Research.