BUYING BONDS Are For Conservative Investors

Buying bonds is known as a strategy for conservative investors. However, there are many reasons why people buy individual fixed income ideas. I’ll go over a some of them below:

Buying bonds is known as a strategy for conservative investors. However, there are many reasons why people buy individual fixed income ideas. I’ll go over a some of them below:

INCOME STREAM- All bonds, including Treasuries, Municipals, and Corporates have set dates when they mature and pay interest to bond holders. When buying bonds for clients, many financial advisors suggest that a laddered portfolio is the best way to go. This strategy not only reduces interest rate risk, but provides predictability of income from the portfolio as well.

TAXATION- Buying bonds for the wealthiest Americans is a little bit different than your standard diversified account. Many high net worth individuals seek the tax benefits that Municipal Bonds provide. For instance if you purchase a bond that is issued in your home state, they are exempt from state, local and federal taxes. U.S. Territory bonds like those issued from Puerto Rico or Guam for instance, also carry the same status. Also keep in mind that buying bonds in General Obligation issues is less risky than purchasing Revenue Bonds. Although most G.O’s carry a lower Yield to Maturity.

BUYING BONDS: Safe Investment

SAFETY and SAVINGS- Some investors tend to get involved in buying bonds for the first time because they have an upcoming event in their lives. Buying a home or paying future college tuition’s are two common examples. In these two instances, many investors simply set aside funds that are deemed to be super safe, and match the maturity of the bond to their time of purchase or payment.

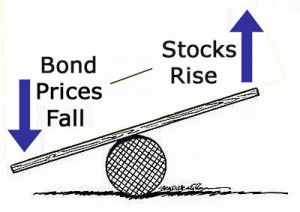

DIVERSIFICATION- We touched on this above, but to give more detail, investors often use financial planning models in their approach to the markets. These models often differ depending on market conditions, or simply because of the brokerage firm, or newsletter that the client uses or reads. A standard approach for many who are buying bonds and looking to reduce stock market risk is owning 80% equity and 20% fixed income.

More Penny Stock News, IPO Updates and Stock Market Research.