Bounce Time?

Stock Futures are up this AM, due to jobless claims falling to 473000. This number wasn’t great, but it was much better than the week before, when claims were over 500000.

Stock Futures are up this AM, due to jobless claims falling to 473000. This number wasn’t great, but it was much better than the week before, when claims were over 500000.

To put this number in perspective, claims rose to the 650000 range last year and a claim number in the 350000-400000 range is generally viewed as a positive for the economy. My sense is that the downfall this week was in anticipation of a disastrous number. Well, it looks like short sellers may be disappointed and a bounce potentially could be near.

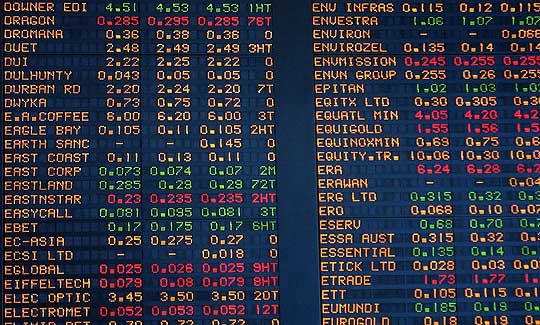

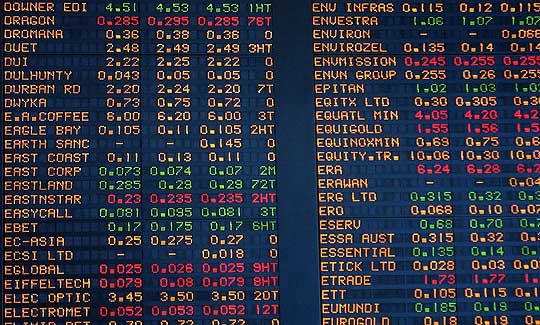

Keep in mind that we have some other factors that could be used a rationale for a bounce. First, we have poor investor sentiment, which has led to anemic volume, all the way from the NYSE down to the penny stock market. We also, have see takeover fever. Large cap companies are going on a buying spree and using cash a the vehicle. Companies like Dell , BHP Billiton and Intel obviously see value at these levels. Lastly, this morning’s number could be pointing to the fact that the economy may not be good, but at the same time isn’t as bad as people think.

Hopefully, this leads to some bottom fishing in the near term. Many of us own blue chip stocks that are down. Some of us also own once hot penny stocks that have lost the interest of investors. My advice is to re-evaluate your portfolio and add to some fallen positions if it makes sense. After you compile your blue chip and penny stock lists. Review each position and see if anything has changed fundamentally. Now if your current losses in the position are not that big, it may may sense to average down.

Adding new positions also might make sense if you have the liquidity. Especially since we may have seen the bottom already in oil prices. A bounce in oil has recently seemed to be a catalyst to the market and could rally the larger exchanges and make quality commodity based penny stocks look attractive.

Whatever you decide to do, make sure it is done relatively small. While we may turn higher from here looking for bounces and bottoms doesn’t always work.

Stock Trading Tips for Penny Stocks

If you like the prospect of being able to see a possible 500% return in just a few hours or are skeptical about losing as much in as little time, take a look at some of these ideas that can help you be more successful.

Penny Stock Trading

Keep Track of your holdings.

One of the worst mistakes that people make when investing in penny stocks is that they will buy the company and then forget that they own it. This could prove to be an extremely costly and unnecessary error for investors. This is a major rule that applies to both blue chips and penny stocks alike. Because of the volatility of penny stocks it is even more important. The chances of your Dell shares spiking 200% in a day and then dropping back to even are pretty slim but because penny stocks can thinly traded, this is an every day occurrence. These are opportunities that you do not want to miss. Put together a penny stock list of your holdings and track them daily.

Don’t invest more than you can lose.

When you see hot penny stocks that is starting to move, it can be hard to keep from taking a 2nd mortgage on your house so you can buy as many shares as possible. Getting in over your head while investing in penny stocks is like fighting a losing battle. You are almost guaranteeing yourself a loss. When penny stock investors own a position that gets cut in half, they will often double their holdings to try and make back their losses. 9 times out of 10 this is an awful mistake. Take a look at why the position is down. It will take a lot of news to retrace a 50% loss. Even though penny stocks can show you some serious profits, they are volatile and have the potential to go the other way just as fast as they spike up.

Listen to the Angel….. Not the Devil.

So you just bought a hot penny stock that jumped 500% in two days. Why not hold it until it hits 1000% right? WRONG!!! Once investors have made a huge profit, they often look to realize the gains. If have a position in an illiquid penny stock that has just made a move, chances are it is going to come right back down when people start to take profits. Set certain entry and exit points on your holdings. Remember that those gains are not realized until you pull the trigger and sell the holdings. Don’t get caught holding the bag.

We will be sending out more penny stock tips to our subscribers at pennystockexplosion.com

Stock Futures are up this AM, due to jobless claims falling to 473000. This number wasn’t great, but it was much better than the week before, when claims were over 500000.

Stock Futures are up this AM, due to jobless claims falling to 473000. This number wasn’t great, but it was much better than the week before, when claims were over 500000.