Tesla Motors and the Electric Car Company

The much anticipated Tesla Motors IPO will begin trading on Tuesday. Goldman Sachs, Morgan Stanley, JP Morgan and Deutsche Bank are the lead underwriters. The offering has also increased in size due to demand for the shares. However, Tesla is the classic concept stock and has never turned a profit. Does that matter ? Probably not.

The much anticipated Tesla Motors IPO will begin trading on Tuesday. Goldman Sachs, Morgan Stanley, JP Morgan and Deutsche Bank are the lead underwriters. The offering has also increased in size due to demand for the shares. However, Tesla is the classic concept stock and has never turned a profit. Does that matter ? Probably not.

Generally concept stocks due exceptionally well in good markets, but tend to get destroyed in bear markets. For instance the solar stocks went down faster than the broader markets in the 2009 crash due to a constant lack of earning visibility and their concept status. In Tesla’s case, the shares are oversubscribed according to some IPO services and may trade at a 1 or 2 point premium on day one. Tesla’s electric cars sell for more than 100k before tax credits which differ from state to state. They have also sold only a little more than 1000 cars. Due to the hype surrounding the deal, fundamental analysis will probably fall on deaf ears in the first week of trading.

As always we try to link some of the hotter ideas in the broader markets to penny stocks on the OTCBB. In this instance look for possible increased activity in Electric Car Company (OTCBB: ELCR) or Li-ion Motors Corp (OTCBB:LMCO). These companies specialize in electric car conversions and may see some sympathetic buying due to the interest in Tesla motors. Time and time again we have seen micro-cap stocks turn into hot penny stocks due interest coming into a larger company within the same space. You don’t need to act yet. As a matter of fact you may not need to act at all. Just be ready. Massive gains in penny stocks are a lot easier to obtain if you have the right information and are prepared.

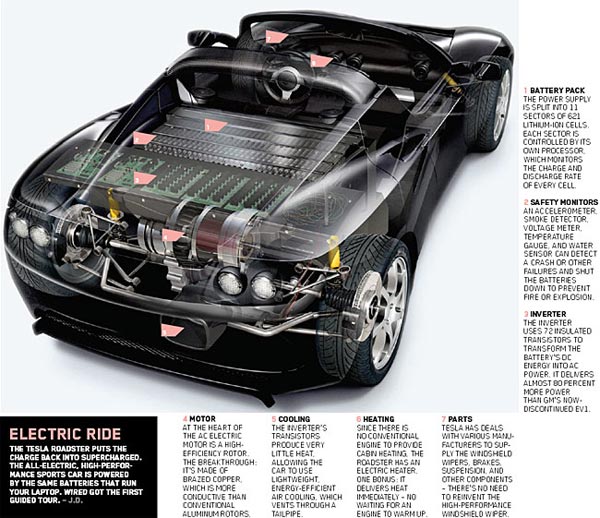

Tesla Motors IPO