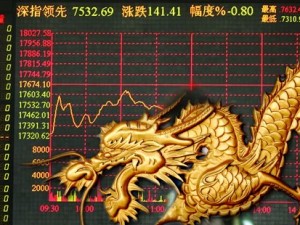

China’s Real Estate Bubble

Chinese stocks fell last night to the tune of slightly less than 3%. At this point many think that the world’s third largest economy may finally be ready to roll over. There have been many opinions on China eventually having a real estate bubble. Others feel their demand for commodities will fall. In theory this shouldn’t bode well for world markets, and especially the NYSE and NASDAQ.

Chinese stocks fell last night to the tune of slightly less than 3%. At this point many think that the world’s third largest economy may finally be ready to roll over. There have been many opinions on China eventually having a real estate bubble. Others feel their demand for commodities will fall. In theory this shouldn’t bode well for world markets, and especially the NYSE and NASDAQ.

However, we have all heard this boom bust story regarding China before. Investors may see not hot penny stocks like returns in Chinese stocks, but history has shown us that it’s usually near the bottom when the media is calling for a crash. We are not saying to take a contrarian attitude and go long Chinese equities, but take the bad news with a grain of salt.

The main concern with China in regard to U.S. stocks has to do with inflation. China’s inflationary fears certainly impact the FOMC’s policy making. Our markets have seen this situation before and Bernanke has pulled us through.

Now how does this impact the OTCBB ? Well, you can look at it two ways. First, the negative sentiment coming out of China will make it difficult for massive short term gains in Chinese Bulletin stocks that trade on the Pink Sheets or Bulletin Board. Penny stock traders often look for momentum and any type of breakout or rally might rare these days with the current news flow out of Beijing.

The second way to look a China from a OTCBB standpoint is a positive one, and it’s a longer term view. Many Chinese stocks trading in the United States are at or near lows. Does this create a buying opportunity ? Maybe. For instance former high fliers like Amico Games Corp. (AMCG.OB) and China Infrastructure Investment (CIIC.OB) are at their lows. We are by no means recommending these two names, but we are pointing out that value may exist in Chinese microcaps. So start forming a penny stock list made of China plays and research them. Odds are that most are at lows and a buy low sell high opportunity might be there. After your list is formed, monitor the Asian markets. If a turn is near, value buyers may take a chance in Chinese large caps and it may trickle down to the OTCBB. Once again, don’t jump in immediately, but be ready and prepared.

What we do know is that large amounts of speculative money was invested in China and in Chinese stocks. These investors were looking for massive gains too. Recent losses overseas may cause the “hot” money to be a little less aggressive. As we all know it is easier to find

What we do know is that large amounts of speculative money was invested in China and in Chinese stocks. These investors were looking for massive gains too. Recent losses overseas may cause the “hot” money to be a little less aggressive. As we all know it is easier to find