Does it Make Sense ?

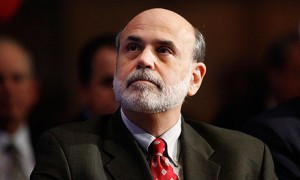

Yesterday U.S. markets traded down and world markets followed suit this morning. Both traders and investors are awaiting Fed Chairman Ben Bernanke’s speech from Jackson Hole. This will surely be the catalyst for Friday’s trading and tape action should be volatile

Now there are different ways to approach buying before the Fed Chairman speaks. It is probably safe to say that Mr. Bernanke has usually been clearer with his words than his predecessor Alan Greenspan. But the problem remains trying to anticipate what their message is. Experience tells me that is a losing battle unless you have a crystal ball. Trying to go either long or short before such an important speech tend not to work because of the choppiness of the market. Many traders get stopped out and then have to watch their former position trade to their initial profit target. Without them in it.

Now you have read recent blogs here about takeovers and market bottoms. However, those market trends apply to investors not traders. For instance, if you had an urge to buy a penny stock like China BTC Pharmacy (OTCBB: CNBI.OB) in the 4 dollar range as a long term hold, it may or may not be wise. However, if you had a 2-3 year window and a price target of 10, a fluctuation of 40 or 50 cents really isn’t an issue. On the other hand, if you were buying this micro-cap name as a momentum play for a short term pop, you often are gambling on Bernanke and market direction. Yes, hot penny stocks sometimes do trade in sympathy with the broader markets.

The age old question of trading before Bernanke especially applies to large cap names, which are obviously more sensitive to the Fed, than OTCBB stocks. But the same philosophy applies. If you are comfortable buying a name like Bank of America (NYSE: BAC) and have a long term investment philosophy,by all means buy the stock. But if you are a short term trader, you must remember that many good ideas turn into losses when the Fed is involved. This is why it is often best, to put the trading ideas on hold. Being impatient in the market is often a recipe for disaster.

No related posts.

Related posts brought to you by Yet Another Related Posts Plugin.