Volume and Liquidity

Penny stocks can will often gain or decrease in value with even the slightest provocation. This can happen with no news or even a limited trading history in the stock. Even if you see a penny stock up 200% in a day, it does not mean that it’s a hot penny stock.

Lets say that there is an investor who loves gold penny stocks. He loves the gold market and thinks that a gold company is a good place to park his assets rather than buying the hard commodity. He wants the most bang for his buck, so rather than invest his $10,000 in Newmont Mining (NEM) he looks for a cheap penny stock.

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

A major part of the process while investing in a penny stock is to understand what driving factors are taken into consideration in the price of penny stock shares. If a penny stock jumps high on very little volume, chances are something like I just mentioned happened.

This is why you must put together a list of penny stocks and take your time to do research on each individual company.

“Short Squeeze”

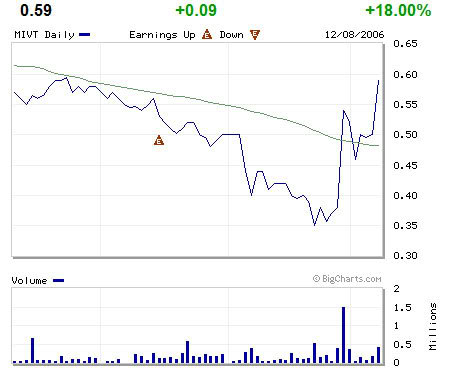

Today let’s talk about the penny stock short squeeze. This is something that happens a lot in the penny stock game. A short squeeze is definitely more likely to happen in a company with a small market cap and a small float. It is harder for a company with a billion dollar market cap to move than it is for a company with a $75 million market cap.

This is the simple concept of supply and demand. When an investor has a short position in a stock it simply means that they are betting that the company is going to decrease in value. This is not really a long shot with 99% of penny stocks out there!!

This is the simple concept of supply and demand. When an investor has a short position in a stock it simply means that they are betting that the company is going to decrease in value. This is not really a long shot with 99% of penny stocks out there!!

When a short squeeze happens in a penny stock, all hell can break loose with the price of the shares. If there is a large short position in the stock and the price of the stock increases, the shorts may be forced to cover. They either want to cut their losses or have to fulfill margin requirements. When the cover the stock, they are actually buying the stock back. This can make the stock jump even further and trigger off more margin calls and creates more buying. It is somewhat of a domino effect.

Take a look at any penny stocks that you own and see if they are on this list and how many shares are short compared to the float.

This is a great penny stocks list for potential investors to take a look at.

Midyear Recap of Penny Stock Leaders

Today we are recapping three of this year’s biggest hot penny stock movers. All of the names mentioned below seem to still be very active and volatile. This could present opportunities for trading or long term investing. There have been some huge moves in the penny stock world this year, but these are some of the more notable and publicized companies. Add these companies to your penny stocks list and keep your eye on them.

Today we are recapping three of this year’s biggest hot penny stock movers. All of the names mentioned below seem to still be very active and volatile. This could present opportunities for trading or long term investing. There have been some huge moves in the penny stock world this year, but these are some of the more notable and publicized companies. Add these companies to your penny stocks list and keep your eye on them.

Cascadia Investments (CDIV.PK)

Cascadia Investments closed at 5.5 cents on December 31, 2009. CDIV is a “True Penny Stock”. Currently CDIV is a favorite of short term penny stock traders and has basically become a very liquid cult stock with a massive message board following. CDIV is a social gaming company that is attempting to gain traction in the multi-billion dollar industry. CDIV has very little revenue despite acquiring several game apps that were developed for the iPhone. Much of the CDIV trading community views the stock as a potential short squeeze candidate. As evidenced by a move to .72 on March 10, 2010.

Rexahn Pharmaceuticals (RNN:AMEX)

Rexhan Pharmaceuticals is a clinical stage biopharma company that proved to be an explosive penny stock winner this year. RNN closed at .68 on December 31, 2009 and traded as high as $3.65 on April 12, 2010. RNN was trading in a bullish uptrend before the big price and volume spike. The move was predicated on positive data from the anxiety and depression Seradaxin and the potential of ED Zoraxel. The stock has pulled back recently and is attempting to build a base.

Radient Pharmaceuticals (RPC:AMEX)

Like Rexahn, Radient Pharma is also a biopharma company that closed at .24 cents on December 31, 2009. Onko-Sure, which is RPC’s cancer screen product attracted major interest in the stock. The low cost of Onko-Sure’s non-invasive test and distribution agreements in Russia and India propelled RPC shares to $2.19 on April 12th, 2010. Since then RPC shares have pulled back and are attempting to form a base. The shares still remain extremely volatile.

Adding the “Q” to WAMU – From a Blue Chip to a Penny Stock

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying hot penny stocks with good prospects and buying a Zombie Stock.

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying hot penny stocks with good prospects and buying a Zombie Stock.

A Zombie stock is generally a company that is near bankruptcy. When the market crashed in 2009 blue chip companies like General Motors, Washington Mutual, Lehman Brothers and AIG filed bankruptcy, causing both retail investors and institutions to take massive losses.

Consequently, these stocks were delisted from the NYSE and traded on the Pink Sheets. They are now classified as “Zombie Stocks“. Now don’t get me wrong there is a niche market for these types of securities. There are investors who flip penny stocks everyday. They move in an out of the stock trying to scalp a 2 to 10% gain. There are also other retail investors who generally are not active penny stock buyers, that will step in on fallen blue chips and view the investment as you would a lottery ticket. Some catalysts for buying Zombie Stocks are massive liquidity and news sensitivity. While most people who engage in this practice eventually lose money, there are some who double, triple or even quadruple their funds in a very short time period. While some view stocks like WAMUQ as a trading paradise, there are probably easier ways to make money in the market.

Consequently, these stocks were delisted from the NYSE and traded on the Pink Sheets. They are now classified as “Zombie Stocks“. Now don’t get me wrong there is a niche market for these types of securities. There are investors who flip penny stocks everyday. They move in an out of the stock trying to scalp a 2 to 10% gain. There are also other retail investors who generally are not active penny stock buyers, that will step in on fallen blue chips and view the investment as you would a lottery ticket. Some catalysts for buying Zombie Stocks are massive liquidity and news sensitivity. While most people who engage in this practice eventually lose money, there are some who double, triple or even quadruple their funds in a very short time period. While some view stocks like WAMUQ as a trading paradise, there are probably easier ways to make money in the market.

Stock Trading Tips for Penny Stocks

If you like the prospect of being able to see a possible 500% return in just a few hours or are skeptical about losing as much in as little time, take a look at some of these ideas that can help you be more successful.

Penny Stock Trading

Keep Track of your holdings.

One of the worst mistakes that people make when investing in penny stocks is that they will buy the company and then forget that they own it. This could prove to be an extremely costly and unnecessary error for investors. This is a major rule that applies to both blue chips and penny stocks alike. Because of the volatility of penny stocks it is even more important. The chances of your Dell shares spiking 200% in a day and then dropping back to even are pretty slim but because penny stocks can thinly traded, this is an every day occurrence. These are opportunities that you do not want to miss. Put together a penny stock list of your holdings and track them daily.

Don’t invest more than you can lose.

When you see hot penny stocks that is starting to move, it can be hard to keep from taking a 2nd mortgage on your house so you can buy as many shares as possible. Getting in over your head while investing in penny stocks is like fighting a losing battle. You are almost guaranteeing yourself a loss. When penny stock investors own a position that gets cut in half, they will often double their holdings to try and make back their losses. 9 times out of 10 this is an awful mistake. Take a look at why the position is down. It will take a lot of news to retrace a 50% loss. Even though penny stocks can show you some serious profits, they are volatile and have the potential to go the other way just as fast as they spike up.

Listen to the Angel….. Not the Devil.

So you just bought a hot penny stock that jumped 500% in two days. Why not hold it until it hits 1000% right? WRONG!!! Once investors have made a huge profit, they often look to realize the gains. If have a position in an illiquid penny stock that has just made a move, chances are it is going to come right back down when people start to take profits. Set certain entry and exit points on your holdings. Remember that those gains are not realized until you pull the trigger and sell the holdings. Don’t get caught holding the bag.

We will be sending out more penny stock tips to our subscribers at pennystockexplosion.com

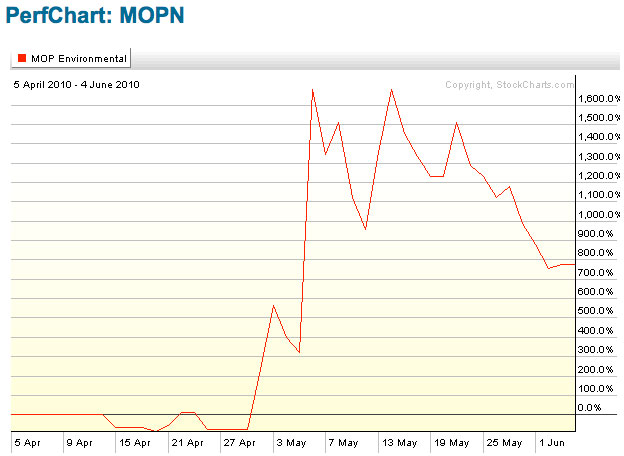

Penny Stock MOPN Cleaning Up BP’s Mess

Why else would we even subscribe to a penny stock newsletter? When your average person on the street hears the word “penny stock” they automatically become disinterested. When a real investor hears the word “penny stock” they automatically see dollar signs.

Not every penny stock is a winner and not every penny stock offers an opportunity. The trick is to throw together a penny stock list of companies that have potential and then start narrowing down your results.

There is a lot of money to be made investing in penny stocks. When was the last time that you looked on your screen and saw that Microsoft, inc (MSFT) or even Google (GOOG) has doubled? It just doesn’t happen with blue chip companies like it does with penny stocks.

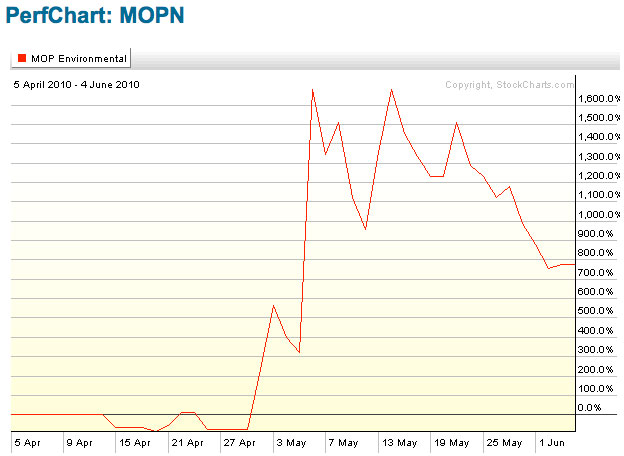

MOPN 30 Day Chart

MOP Environmental Solutions, Inc. (MOPN) was virtually an unknown penny stock last week. Friday after the close the company announced that they had received a purchase order from British Petroleum (BP) in order to assist in the clean up process in the Gulf of Mexico. The stock is up 267% today so far. It jumped from .08 to .35 earlier today after opening at .16. Not bad for a days work.

This is a common occurrence in the world of penny stocks. I see it happen everyday. The key is to find the company before it happens. This is what we do here at pennystockexplosion.com

Still not convinced you can make money with small cap stocks?

What I am about to tell you might shock you.

If you are not familiar with the Russell 2000 index, you should Google it. The Russell 2000 tracks small cap stocks. Over the past two years we have seen the low point in the markets occur during February and March of 2009. I took a look at the Russell 2000, the S&P 500 and the Dow and compared their performance to date. The Russell outperformed the Dow by a massive 71% and the S&P 500 by close to 40%.

I am sure that now you are a believer in penny stocks. We will have some more relevant information coming soon.

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying

“Zombie Stocks” Trading as Penny Stocks: WAMUQ , LEHMQ. If you see a “Q” at the end of a stock symbol take it with a grain of salt. And if you do decide to buy the stock, only risk capital that you can afford to lose. As we all know many investors are lured to penny stocks. The hope of a large percentage gain often outweighs the fear of losing money. However, there is a difference between buying  Consequently, these stocks were delisted from the NYSE and traded on the

Consequently, these stocks were delisted from the NYSE and traded on the