SILA – Gold American Mining Corp

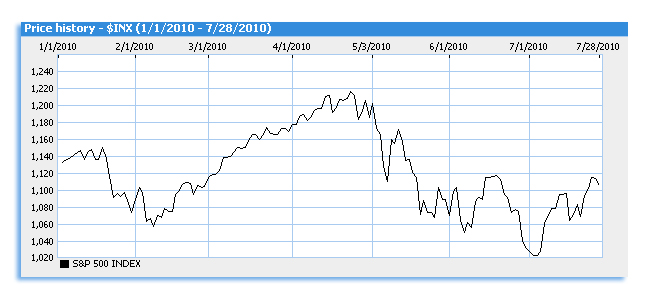

We have an exciting new gold play right now. Gold has pulled back 5% this month with the recovery in the markets but is still holding a strong 26% gain over the past year. Investors who don’t invest in physical gold look for the next best thing and that is gold stocks. The market is still in a bearish trend and generally when this happens gold stocks are still in play.

We have an exciting new gold play right now. Gold has pulled back 5% this month with the recovery in the markets but is still holding a strong 26% gain over the past year. Investors who don’t invest in physical gold look for the next best thing and that is gold stocks. The market is still in a bearish trend and generally when this happens gold stocks are still in play.

We have found what we believe could be the next junior miner that could be making major headlines.

We want everyone to put SILA (Gold American Mining Corp.) on your radar immediately.

This is a company that has made some very big moves lately and has pulled back nicely. Last week the stock moved from $0.80 to $1.16 (about 45%) and I’m expecting we could see a move like this again early next week.

According to Emerging Stock report SILA has Support at $1.03, with resistance at $1.15. There has been a lot of accumulation at higher levels which typically means there will be little resistance in the stock until investors reach the breakeven level.

We could see a nice pop and some momentum before we see any heavy selling.

SILA is extremely liquid right now. The average volume over the past two weeks has been 800k shares.

Recent activity has pushed the market cap to close to $80 million!!

Every mining company has to have adequate funding in order to pay for drilling operations and the extraction of minerals from the ground. Right now it is estimated that SILA is sitting on an estimated $8.5 billion worth of gold and silver combined on their Mexican and American properties.

This would mean nothing if they did not have sufficient means of pulling it out of the ground. SILA secured a 2-year, $7.5 million equity financing agreement with ZUG Financing Group S.A. in May:

The ZUG group specializes in backing precious metals and mining ventures. This incredible news will keep Gold American busy the next 2 years, in continued development and exploration of their Mexico and Nevada properties. In all, the deal could represent $10.75 million in funding over the next 2 years if the company assumes the full execution of the attached warrants.

SILA’s main property is located in Mexico. The 698.91- acre Guadalupe property in Mexico contains two historically significant mines, and is only about 5 miles north of the Fresnillo Mine, which is the world’s richest underground silver mine. That mine produced over 24,000 ounces of gold in 2009 alone.

Mexico’s mine production of gold increased 10% from 2008 to 2009, and is now the third leading exporter of gold into the US. As exploration and development in Mexico has picked up, SILA has made a timely move to expand their production. The field surveys confirmed the project’s significant potential by returning several high-grade silver results.

SILA’s 2nd acquisition, The Keeno property in Nevada could potentially contain 1.1 million ounces of gold, and 69 million ounces of silver.

It is obvious that The Street is bullish on SILA right now. We have seen tens of millions of investment dollars being thrown at SILA in the open market. We have traders looking to take small profits but it also looks like there is a core of longer term investors waiting on SILA to start the extraction process.

SILA looks great both longer and shorter term right now. Make sure to start your research immediately.

Make sure you visit www.gold-american.com.

Always make your own investment decisions and consult a professional. Never invest more than you can afford to lose*

The disclaimer is to be read and fully understood before using our site, or joining our email list

PLEASE NOTE WELL: The Pennystockexplosion.com employees are not Registered as an Investment Advisor in any jurisdiction whatsoever.

Full disclaimer can be read at http://www.Pennystockexplosion.com/disclaimer.htm

Release of Liability: Through use of this website viewing or using you agree to hold Pennystockexplosion.com, its operators employees harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur. The information contained herein is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Pennystockexplosion.com affiliates may from time to time have a position in the securities mentioned herein and may increase or decrease such positions without notice which may negatively affect the market. We have been compensated ten thousand dollars by a third party, Gallaxy Partners, LLC for a one day investor awareness campaign on SILA. Pennystockexplosion.com encourages readers and investors to supplement the information in these reports with independent research and other professional advice. All information on featured companies is provided by the companies profiled, or is available from public sources and Pennystockexplosion.com makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled companies. Pennystockexplosion.com, nor any of its affiliates are not registered investment advisors or a broker dealers. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the companies profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead Pennystockexplosion.com strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Pennystockexplosion.com does not offer such advice or analysis, and Pennystockexplosion.com further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the companies profiled. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be “fwdlooking statements”. Fwdlooking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks of uncertainties which could cause actual results or events to differ materially from those presently anticipated. Fwdlooking statements in this action may be identified through use of words such as “projects”, “foresee”, “expects”, “will”, “anticipates”, “estimates”, “believes”, “understands”, or that by statements indicating certain actions “may”, “could”, or “might” occur. Understand there is no guarantee past performance will be indicative of future results. In preparing this publication, Pennystockexplosion.com has relied upon information supplied by its customers, and press releases which it believes to be reliable; however, such reliability cannot be guaranteed. Investors should not rely on the information contained in this website. Rather, investors should use the information contained in this website as a starting point for doing additional independent research on the featured companies. The advertisements in this website are believed to be reliable, however, Pennystockexplosion.com and its owners, affiliates, subsidiaries, officers, directors, representatives and agents disclaim any liability as to the completeness or accuracy of the information contained in any advertisement and for any omissions of materials facts from such advertisement. Pennystockexplosion.com is not responsible for any claims made by the companies advertised herein.

Recently we have seen a rally in copper prices, which historically indicates a rally for U.S. equities. Freeport MacMoran Copper and Gold (NYSE:FCX) has come back into favor and has always been a darling of short term traders and hedge fund managers. FCX is one of the few NYSE stocks that moves like a penny stock. Keep in mind that FCX could have a massive move in either direction. The optimism in copper prices last week leads some investors to go long equities. At this point FCX is a good of a barometer for the direction of the market as you can find.

Recently we have seen a rally in copper prices, which historically indicates a rally for U.S. equities. Freeport MacMoran Copper and Gold (NYSE:FCX) has come back into favor and has always been a darling of short term traders and hedge fund managers. FCX is one of the few NYSE stocks that moves like a penny stock. Keep in mind that FCX could have a massive move in either direction. The optimism in copper prices last week leads some investors to go long equities. At this point FCX is a good of a barometer for the direction of the market as you can find.

Sanofi-Aventis (NYSE-SNY) now has approval from the board of directors to offer as much as $70 per share for Genzyme (NASDAQ:GENZ). This equals roughly $18.7 billion for the transaction. Last week we mentioned that the Biotech ETF (NYSE:BBH) was a more conservative way to take advantage of the GENZ takeover rumor.

Sanofi-Aventis (NYSE-SNY) now has approval from the board of directors to offer as much as $70 per share for Genzyme (NASDAQ:GENZ). This equals roughly $18.7 billion for the transaction. Last week we mentioned that the Biotech ETF (NYSE:BBH) was a more conservative way to take advantage of the GENZ takeover rumor.

Biotech company Genzyme (

Biotech company Genzyme ( Recent history has shown us that

Recent history has shown us that  Last week we saw two Smart Technologies (NASDAQ:SMT) and Qlik Technologies (NASDAQ:QLIK) trade at first day premiums. While QLIK held it’s gain and traded even higher during the next trading session, SMT plummeted and hasn’t traded back to it’s issue price of $17. These recent results are just another example of how unpredictable the

Last week we saw two Smart Technologies (NASDAQ:SMT) and Qlik Technologies (NASDAQ:QLIK) trade at first day premiums. While QLIK held it’s gain and traded even higher during the next trading session, SMT plummeted and hasn’t traded back to it’s issue price of $17. These recent results are just another example of how unpredictable the  Goldman Sachs (NYSE:GS) reports earning on Tuesday, which always brings substantial interest into the large cap financial name. To many, it seems that the sentiment surrounding GS has changed to mildy positive, while the sentiment of its peer Bank of America (NYSE: BAC) hasnt been as strong. The company was just removed from the GS conviction buy list.

Goldman Sachs (NYSE:GS) reports earning on Tuesday, which always brings substantial interest into the large cap financial name. To many, it seems that the sentiment surrounding GS has changed to mildy positive, while the sentiment of its peer Bank of America (NYSE: BAC) hasnt been as strong. The company was just removed from the GS conviction buy list.