How Will This Effect Penny Stock Trading?

Today the Federal Reserve was once again true to their word. The benchmark interest rate remained unchanged. The FOMC also mentioned that while the U.S. economy is improving, problems in Europe could slow down growth in America.

Today the Federal Reserve was once again true to their word. The benchmark interest rate remained unchanged. The FOMC also mentioned that while the U.S. economy is improving, problems in Europe could slow down growth in America.

Many large brokerage firms feel that due to the problems abroad, a rate hike here in the U.S. is unlikely until sometime next year. To me, that sounds like it makes good sense. Now, how does that affect penny stocks and companies that trade on the OTCBB.

Well, historically small cap and micro cap companies do better in low interest rate environments. This is due to the low cost of borrowing and more readily available supplies. But as you have probably read here before, hot penny stocks usually make huge moves based on a positive news release or an event related to the stock. Unlike Intel (INTC) or Disney (DIS), the big percentage gainers on the OTCBB or Pinksheets generally don’t move in sympathy with the S&P 500 or the NASDAQ 100.

Do your homework if you are looking for the next hot penny stock. You will not get a signal from Bernanke or the broader market to find the next penny stocks to watch. Low interest rates don’t hurt, but the biggest winners have come from special situations. Not from the Fed.

Check back for more blog entries and look for our next hot penny stock alert.

Yesterday we saw an interesting development with the revaluation of the Yuan in China. The move seemed to have an impact as steel stocks rallied and while gold and copper stocks were weakened.

Yesterday we saw an interesting development with the revaluation of the Yuan in China. The move seemed to have an impact as steel stocks rallied and while gold and copper stocks were weakened. We all know that

We all know that  We found this hidden

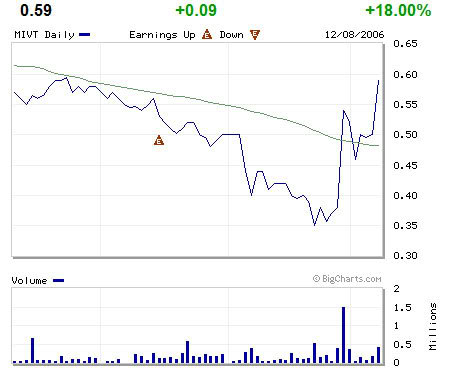

We found this hidden  The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.

The uneducated investor puts in a market order for said penny stock. The penny stock he chose was extremely illiquid and hasn’t traded a share in weeks. This could result in a 100% leap in the price of the stock because of the buying pressure. Now the market cap on this stock just doubled on a $10,000 investment. The market cap is now twice that of what it was 30 seconds before the trade. Is this justified?? No. This could be a false catalyst to peak the interest of an uneducated investor who is using a stock screener that alerts them to increases in price on penny stocks. This stock will eventually drift back down as there is no more buying in the stock.