Think an IPO Offering is Safe? Think Again

As many of you may know, the IPO market has been very shaky recently. Some deals have seen penny stock like volatility. We have seen a flood of private equity deals come to the market, and this has turned institutions and retail investors sour on some of the last few offerings. Express Inc. (NYSE:EXP) is a prime example. Express was once a division of The Limited Brand (NYSE:LTD) until a majority stake was taken by Golden Gate Private Equity. As all private equity firms do, Golden Gate cashed in on the IPO.

As many of you may know, the IPO market has been very shaky recently. Some deals have seen penny stock like volatility. We have seen a flood of private equity deals come to the market, and this has turned institutions and retail investors sour on some of the last few offerings. Express Inc. (NYSE:EXP) is a prime example. Express was once a division of The Limited Brand (NYSE:LTD) until a majority stake was taken by Golden Gate Private Equity. As all private equity firms do, Golden Gate cashed in on the IPO.

The once solid Express deal, lost street interest and was priced at $17. This was below the original price talk of $18- $20 that was expected. Today, the stock is trading in the $13 range. As mentioned above, this has cast doubt into future private equity IPO’s and may continue into the near future. Even with companies as established as Express.

The Toys “R” Us IPO could be the next test of this trend. KKR and Bain Capital have large stakes in the $800 million IPO. IPO’s in some regard are like hot penny stocks. They offer the chance of high percentage gains to speculative investors.

Next week’s flagship IPO is CBOE Holdings. Goldman Sachs is the lead manager of the deal. Some IPO services are calling for a $4 premium on the first day of trading. The deal is being priced between $27-$29. As most people know, CBOE like most highly anticipated IPO’s will be as volatile as a high beta gold stock on the first day of trading. Since IPO allocations of CBOE for retail investors will be virtually non-existent, most retail investors will be forced to participate in the aftermarket.

Keep in mind that while the reward is there, the risk is too.

Subscribe to our penny stock newsletter to stay up to date with the market!

Stock Trading Tips for Penny Stocks

If you like the prospect of being able to see a possible 500% return in just a few hours or are skeptical about losing as much in as little time, take a look at some of these ideas that can help you be more successful.

Penny Stock Trading

Keep Track of your holdings.

One of the worst mistakes that people make when investing in penny stocks is that they will buy the company and then forget that they own it. This could prove to be an extremely costly and unnecessary error for investors. This is a major rule that applies to both blue chips and penny stocks alike. Because of the volatility of penny stocks it is even more important. The chances of your Dell shares spiking 200% in a day and then dropping back to even are pretty slim but because penny stocks can thinly traded, this is an every day occurrence. These are opportunities that you do not want to miss. Put together a penny stock list of your holdings and track them daily.

Don’t invest more than you can lose.

When you see hot penny stocks that is starting to move, it can be hard to keep from taking a 2nd mortgage on your house so you can buy as many shares as possible. Getting in over your head while investing in penny stocks is like fighting a losing battle. You are almost guaranteeing yourself a loss. When penny stock investors own a position that gets cut in half, they will often double their holdings to try and make back their losses. 9 times out of 10 this is an awful mistake. Take a look at why the position is down. It will take a lot of news to retrace a 50% loss. Even though penny stocks can show you some serious profits, they are volatile and have the potential to go the other way just as fast as they spike up.

Listen to the Angel….. Not the Devil.

So you just bought a hot penny stock that jumped 500% in two days. Why not hold it until it hits 1000% right? WRONG!!! Once investors have made a huge profit, they often look to realize the gains. If have a position in an illiquid penny stock that has just made a move, chances are it is going to come right back down when people start to take profits. Set certain entry and exit points on your holdings. Remember that those gains are not realized until you pull the trigger and sell the holdings. Don’t get caught holding the bag.

We will be sending out more penny stock tips to our subscribers at pennystockexplosion.com

Record Sales for Silver American Eagles

Yesterday we talked a little bit about gold and why gold is a safe investment. If you are more of a speculative investor, we showed why your normal blue chip gold stock doesn’t explode when the price of gold moves.

Penny Stocks that are in the mining and exploration sector very rarely with move with the price of gold or oil.

Penny Stocks are news driven. The past few weeks we saw some penny stocks move on some speculation and contracts tying these companies to the Gulf of Mexico oil spill.

I look at penny stocks and read financial websites roughly 8 to 12 hours a day. This is my life. I know the world markets inside and out. I concentrate my efforts on otcbb stocks because with the right research they give you the greatest opportunity for massive gains.

While I was doing my research and trying to locate the next hot penny stock, I couldn’t help but notice all of the buzz about silver. Silver stocks are becoming more attractive to investors who feel that they may have missed the big spike in gold.

Silver is a great alternative to investing in gold. We saw the spot price of silver jump 4% the other day.

Investing In Silver

The U.S. mint just announced record sales in the month of May for Silver American Eagles. They sold an astounding 3,636,500 units. There is no doubt that the demand for silver is on the rise. Take a look at what I have discovered after reading a few other financial publications.

The U.S. investment demand for gold is only 3.66 times higher than silver if you base it off of American Eagle Sales. The total above ground inventories of gold is valued at $2.44 trillion. While the silver inventories are worth a mere $17.4 billion. This would mean that the worlds above ground gold inventories are valued at 140 times more than the silver inventories, yet the demand is on 3.66 times greater?

I feel that we could see a huge boom in silver over the next year. You have three ways to invest in silver; bullion, stocks, and minted coins.

I am currently researching all of the junior mining companies to find the next great small cap silver company. If I come across anything, I certainly will release it to all of the subscribers on the site.

I will be releasing a new penny stock pick on Thursday night after the close. Make sure that you are signed up on the email list so that you can get it before the market open.

Penny Stock MOPN Cleaning Up BP’s Mess

Why else would we even subscribe to a penny stock newsletter? When your average person on the street hears the word “penny stock” they automatically become disinterested. When a real investor hears the word “penny stock” they automatically see dollar signs.

Not every penny stock is a winner and not every penny stock offers an opportunity. The trick is to throw together a penny stock list of companies that have potential and then start narrowing down your results.

There is a lot of money to be made investing in penny stocks. When was the last time that you looked on your screen and saw that Microsoft, inc (MSFT) or even Google (GOOG) has doubled? It just doesn’t happen with blue chip companies like it does with penny stocks.

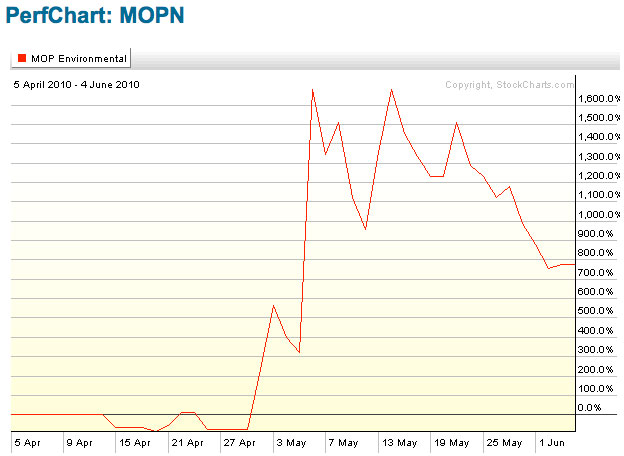

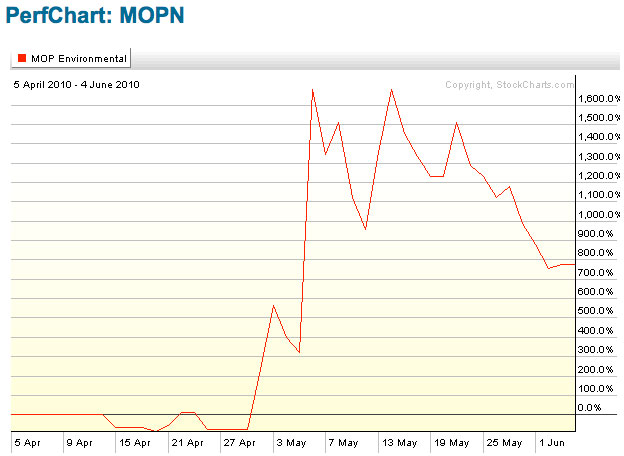

MOPN 30 Day Chart

MOP Environmental Solutions, Inc. (MOPN) was virtually an unknown penny stock last week. Friday after the close the company announced that they had received a purchase order from British Petroleum (BP) in order to assist in the clean up process in the Gulf of Mexico. The stock is up 267% today so far. It jumped from .08 to .35 earlier today after opening at .16. Not bad for a days work.

This is a common occurrence in the world of penny stocks. I see it happen everyday. The key is to find the company before it happens. This is what we do here at pennystockexplosion.com

Still not convinced you can make money with small cap stocks?

What I am about to tell you might shock you.

If you are not familiar with the Russell 2000 index, you should Google it. The Russell 2000 tracks small cap stocks. Over the past two years we have seen the low point in the markets occur during February and March of 2009. I took a look at the Russell 2000, the S&P 500 and the Dow and compared their performance to date. The Russell outperformed the Dow by a massive 71% and the S&P 500 by close to 40%.

I am sure that now you are a believer in penny stocks. We will have some more relevant information coming soon.

Liberty Star Uranium & Metals Corp. (OTC: LBSR) dropped 37.04% to $0.0017 after the broadcast of obtaining a notice from the Collateral Agent of Default. (OTC:LBSR), (LBSR)

Emisphere Technologies Inc. (OTC: EMIS) increased 7.26% to $3.40 after agreeing on an extensive partnership with Novartis, and discontinuing its changeable promissory note. (OTC:EMIS), (EMIS)

Strategic Rare Earth Metals Inc. (OTC: SREH) dropped 1.00% to $0.0298. The company revealed its plans to inflate the wide array of revolutionary iPhone application sales launching on July 1. (OTC:SREH), (SREH)

GoldSpring Inc. (OTC: GSPG) dropped 2.86% to $0.0068. The company established the FINRA approval for its reverse stock split. (OTC:GSPG), (GSPG)

Novo Energies Corp. (OTC: NVNC) increased 30.00% to $0.130 after reaching an official contract with Novo Energies International Ltd. (OTC:NVNC), (NVNC)

As many of you may know, the IPO market has been very shaky recently. Some deals have seen penny stock like volatility. We have seen a flood of private equity deals come to the market, and this has turned institutions and retail investors sour on some of the last few offerings. Express Inc. (NYSE:EXP) is a prime example. Express was once a division of The Limited Brand (NYSE:LTD) until a majority stake was taken by Golden Gate Private Equity. As all private equity firms do, Golden Gate cashed in on the IPO.

As many of you may know, the IPO market has been very shaky recently. Some deals have seen penny stock like volatility. We have seen a flood of private equity deals come to the market, and this has turned institutions and retail investors sour on some of the last few offerings. Express Inc. (NYSE:EXP) is a prime example. Express was once a division of The Limited Brand (NYSE:LTD) until a majority stake was taken by Golden Gate Private Equity. As all private equity firms do, Golden Gate cashed in on the IPO.

Yesterday we talked about some of the advantages of investing in

Yesterday we talked about some of the advantages of investing in